Over the course of the past year, my parents have been looking for a new house to fit our growing family. At the dinner table, they’re always remarking about the changes in the housing market. Just listening to their words worries me.

I keep wondering: How in the world will I be able to afford a house when I graduate?

It is no secret that the prices of houses within the U.S. have risen and have made it more difficult to afford a house. As a junior I will, sooner or later, have to deal with the problems of the housing market just as the seniors before me.

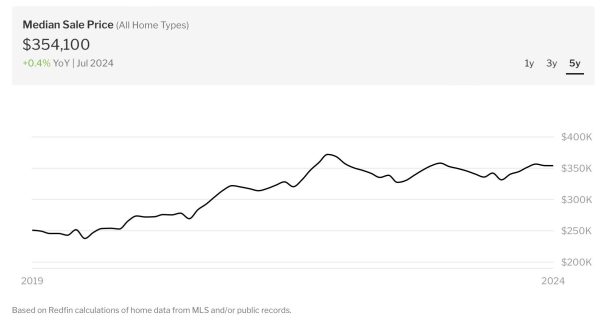

The median residence selling price in Texas is $354,000 per house. This is a lot compared to the median home selling price in 2019, which was $251,000. This represents an approximate $103,000 difference in just five years; that’s over $20,000 a year. This adds up to a 41% increase in those five years and 8.2 percent each year. If this trend continues, the median price will be about $395,000 by the time I graduate.

(via Redfin)

Even renting has been hit with an increase. In 2019, the average monthly rent price in Texas was $1,091 per month, or $13,092 a year. After a meek five years, it has increased to $1,935 per month; that being $23,220 a year. This adds up to a mountinous 77% increase over five years.

It feels like a slowly closing in wall knowing that graduating seniors have to deal with this increase when planning to move out of their parents house. The average salary of a high school graduate in 2024 is $42,590. The average amount of money to pay for housing related costs is about a third of someone’s salary.

So the time it would take to fully cover the cost of an average house right now is 25 years.

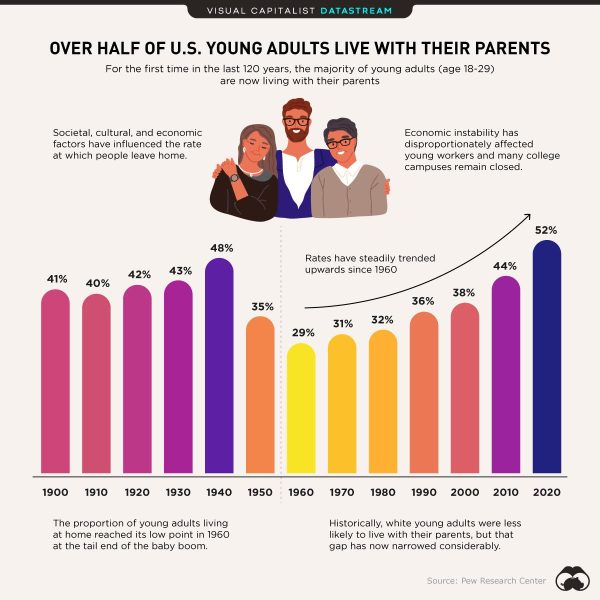

In that amount of time, different things could have happened to interrupt saving money: unexpected medical emergencies, family loss, inflation. It is no wonder about half of young adults ages 18 to 34 currently live at home with their parents. I wouldn’t be surprised if, in the next decade, it only gets higher.

(Graphic via )

Even after going to college and earning a degree to get a higher paying job, student loan debts put significant financial burdens on young adults when buying a house. About 30 to 40% of undergraduate students borrow money to fund their college expenses. This gives anyone a reason to step back and live at their parents’ homes until they can secure a place to stay without them.

Those whose families aren’t financially stable enough to help them with stepping into the adult world are forced to gather and save money themselves. It’s stressful. This, along with the stress of responsibility, add to the mountain of things they need to get done as a newly fledged adult.

Looking at all of these daunting problems makes graduating and becoming an adult frightening. Stress, money, inflation, groceries, taxes, payments, family, friends and relationships are things we are going to have to push through, understand or overcome when we step into adulthood. When the end of the school year rolls around and I see the seniors graduate, I can only hope they can figure life out for adulthood because I know I will be next.